As a holistic non-profit housing developer, Habitat for Humanity New York City believes that we should never abandon anyone who has the desire to work with us to build strength, stability and self-reliance through housing. We strive to provide services even for those who applied, but were ultimately not accepted into our Home Purchase Program. One of the ways we do this is through our Financial Literacy program.

The Financial Literacy program works to retain clients declined from our Home Purchase Program for credit-related reasons. Through the program, we connect clients with credible community resources to improve their and their family’s financial fitness and accomplish their ultimate goal of homeownership. Not only that, our Financial Literacy program does not stop once someone is accepted into the Home Purchase Program – we also offer financial resources to our Homebuyers and Homeowners.

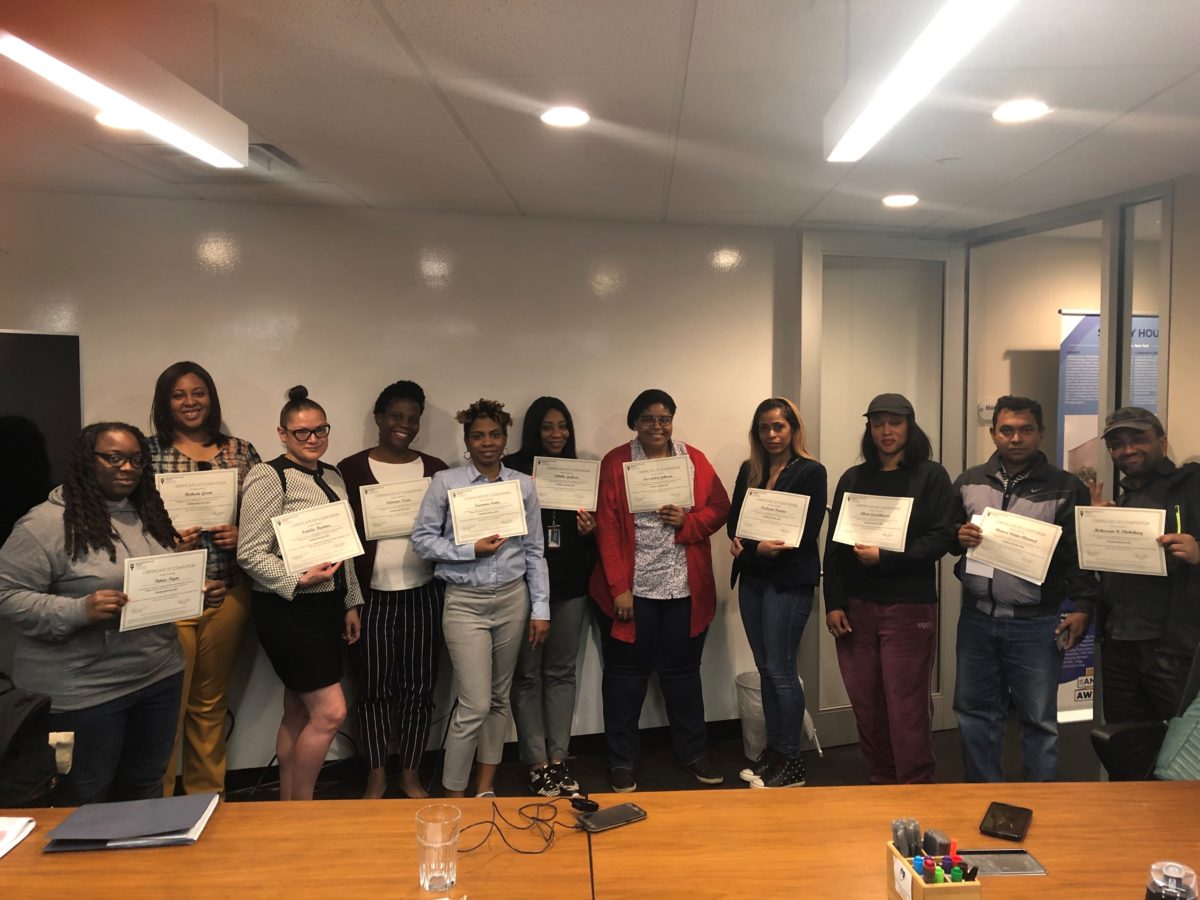

In April 2019, a group of applicants, including Habitat Homebuyers, completed the NTFP Financial Education class.

One of our closest partners in the Financial Literacy program is the Neighborhood Trust Financial Partners, with whom we’ve partnered for more than four years. NTFP is a non-profit social enterprise that partners with a multitude of institutions to serve financially underserved populations. Their staff facilitate quarterly workshops with Habitat NYC clients in our downtown Manhattan offices.

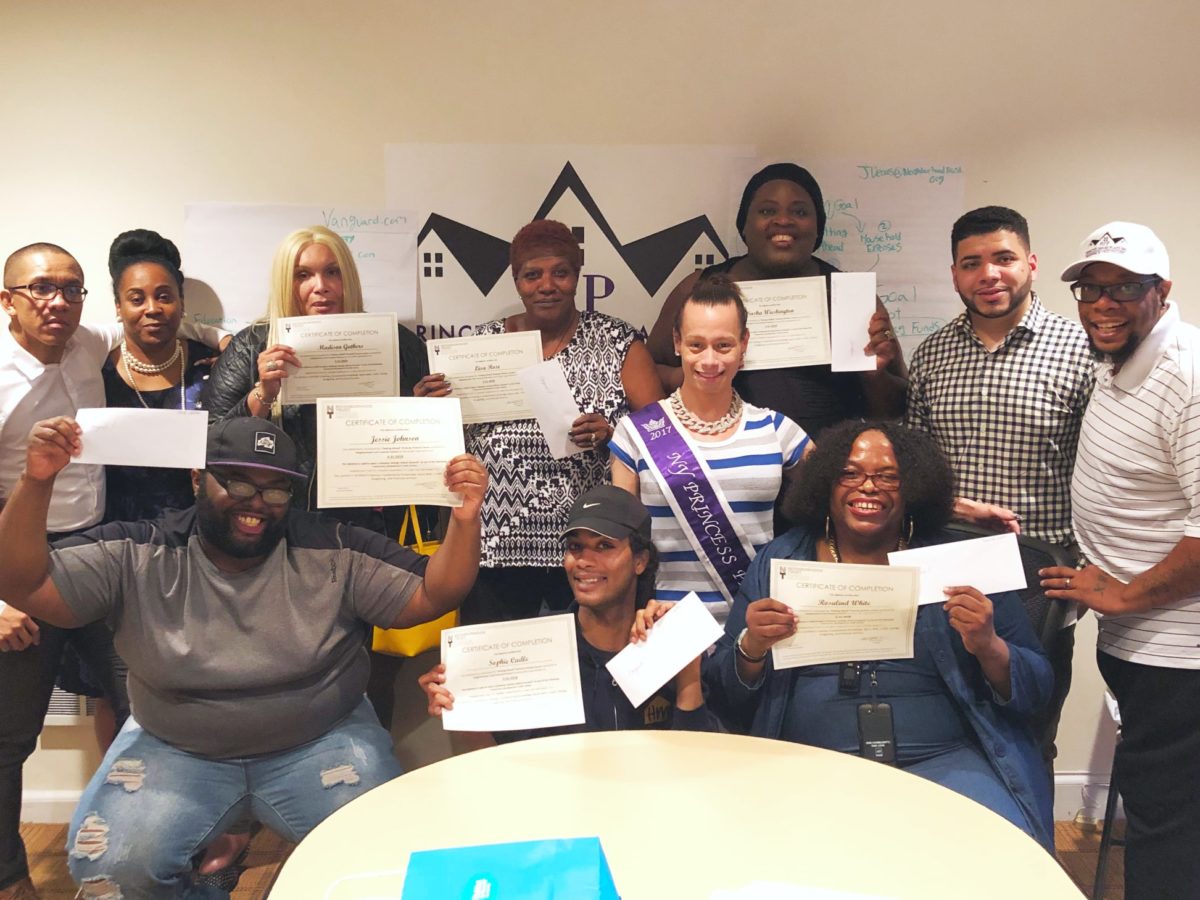

As part of Habitat NYC’s Built with Pride LGBTQ outreach, we worked together with NTFP to provide financial education to clients from Princess Janae Place, a non-profit that provides shelter, mental health, legal, job placement, and general support services for transgender and non-gender binary people as they transition from homelessness to independent living. Trans and gender non-binary people often face many barriers to financial health, including unemployment or sporadic employment, lack of access to savings, 401(k)s, credit and more.

Habitat NYC teamed up with our partners to provide a Financial Literacy course to the folks at Princess Janae Place.

Habitat NYC has also worked with the Financial Planning Association of New York, which is committed to public education about the financial planning process and an understanding of the benefits of financial planning. They have facilitated a number of workshops with our Financial Literacy clients over the past two years.

Our Home Purchase Program may not be for everyone who applies, but we believe that credit or any other financial issues should not disqualify anyone from improving their finances, and even owning a home in the future. Our Financial Literacy program has served more than 60 clients in the past two years alone, and we look forward to serving even more New Yorkers.

Want to learn more about our Home Purchase Program? Check it out on our site.